Strategic Business Environment Key to Success in Japan

본문

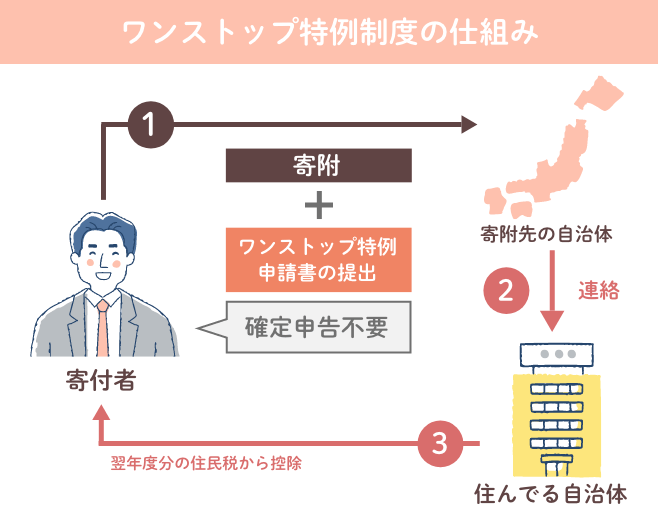

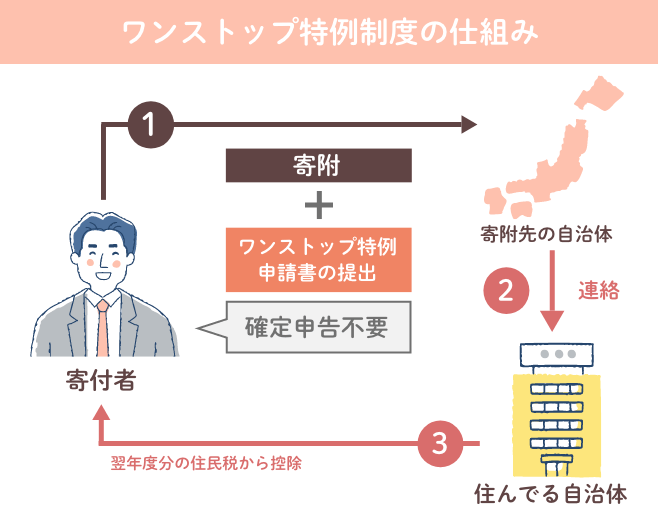

Japan has long been known for its favorable business environment that facilitates large-scale corporations in growth. One intriguing aspect of this environment is the influence of corporate philanthropy, more particularly Native Donations, also known as 'in-kind donations' or 'donations in kind' in Japan. It's essential for startups and business owners alike, and even Western nations, to comprehend this type of donation in the context of their financial partnerships with Japan.

It's essential for startups and business owners alike, and even Western nations, to comprehend this type of donation in the context of their financial partnerships with Japan.

The concept of kyojibunkai or 'Native Donations' refers to a company making willing donations to local public or private sector organizations. This most frequently occurs when the company decides to donate in-kind donations like office supplies, used machinery, vehicles, computers, goods produced by their existing production lines, or other types of assets.

The key benefits that in-kind donations hold for Japan are a more visible form than monetary donations as it in fact places limited demand on Japan's financial budget while supporting social reconstruction at the same time. In contrast to a simple cash donation, in-kind donations allow the donating entity to obtain tax deductions in line with the Japan public tax office's valuation of such goods or services.

When planning to collaborate with a local partner, in understanding and 企業版ふるさと納税 いつまで recognizing corporate Native Donations a key step can take place. Donations such as this may give a significant impression on the businesses willingness to help develop Japan's business growth. Given the deep cultural bonds placed in making collective efforts towards society and business growth in Japan.

It's essential for startups and business owners alike, and even Western nations, to comprehend this type of donation in the context of their financial partnerships with Japan.

It's essential for startups and business owners alike, and even Western nations, to comprehend this type of donation in the context of their financial partnerships with Japan.The concept of kyojibunkai or 'Native Donations' refers to a company making willing donations to local public or private sector organizations. This most frequently occurs when the company decides to donate in-kind donations like office supplies, used machinery, vehicles, computers, goods produced by their existing production lines, or other types of assets.

The key benefits that in-kind donations hold for Japan are a more visible form than monetary donations as it in fact places limited demand on Japan's financial budget while supporting social reconstruction at the same time. In contrast to a simple cash donation, in-kind donations allow the donating entity to obtain tax deductions in line with the Japan public tax office's valuation of such goods or services.

When planning to collaborate with a local partner, in understanding and 企業版ふるさと納税 いつまで recognizing corporate Native Donations a key step can take place. Donations such as this may give a significant impression on the businesses willingness to help develop Japan's business growth. Given the deep cultural bonds placed in making collective efforts towards society and business growth in Japan.